I am so excited to share with you one of the best budgeting hacks I know!

The 70/20/10 budget is one of THE BEST ways to use budget percentages to divide up your paycheck. It lets you easily plan for all your expenses, saving, debt payoff and more!

You can pretty much have ANY income, and this budget plan will work for you!

Let’s dive in!

70-20-10 Budget Rule

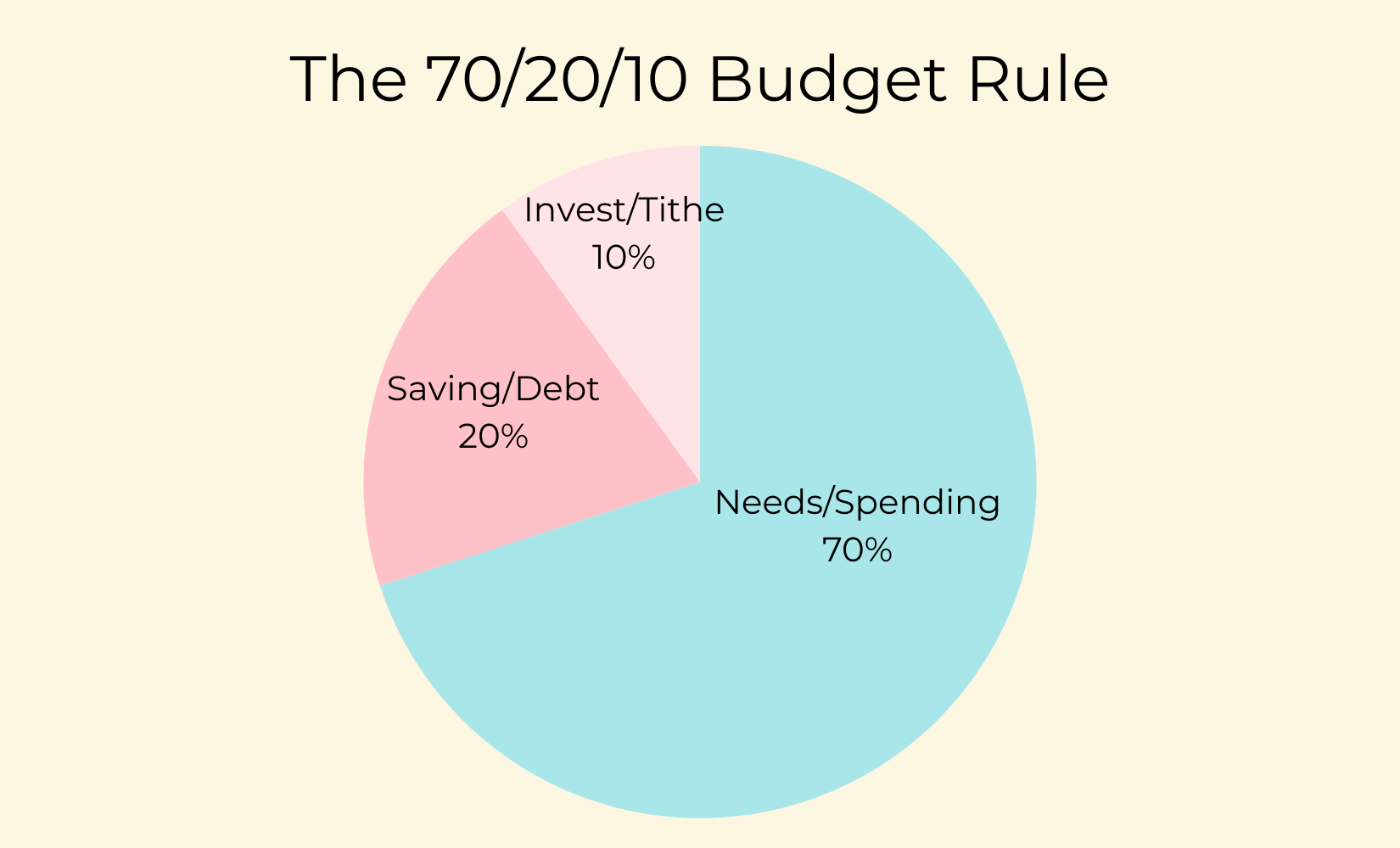

Similar to the 50-30-20 budget rule, managing your money with the 70-20-10 method involves dividing your paycheck into three major categories. Those categories are spending, saving/debt payoff, and giving/investing.

70% of your income is dedicated to monthly spending.

70% = Spending

This involves all spending–both fixed expenses and variable expenses. All bills, living expenses, groceries, and any spending during the month, etc falls into this category.

Since there is no separation between wants versus needs, or fixed versus variable, it would be wise to add up all your normal monthly spending to make sure 70% of your will cover the amount.

20% of your after-tax income is then dedicated to savings and debt payoff.

20% = Savings/Debt

Whether you want to save for short term goals, or you need to tackle your own debt monster, this category is for those goals.

You can decide how much of this 20 percent goes toward your financial goals.

If you are heavily in debt, you might want to devote more of this portion to debt payoff. Save for your emergency fund, and then start attacking that debt!

This way you can get out of debt and start saving even more for the future.

The final 10% of your income is for giving or investing.

10% = Giving/Investing

This budget plan also gives you the chance to focus on being generous.

Whether you choose to give to specific organizations, pay a monthly tithe to your church or any other option, this budget helps you focus on looking outside of your self.

This is also where you can focus on saving/investing for retirement.

70/20/10 Budget Rule Example

Want to see how this budgeting rule works in the real world and in real life?

Over on the good ‘ol Tiktok, I have made several videos showing how to divide up a paycheck using the 70/20/10 method. Here is one example:

And here is an example of a real life budget, using the 70/20/10 budget rule and a worksheet we created, specifically to help you make a 70/20/10 budget for yourself.

In this example, the family has $6000 a month in total income to work with.

In the Needs section, they can use $4200 for their monthly expenses and spending. All expenses are met with this amount.

In the Savings and debt section, they have $1200 allocated. Check out how how they used that money below.

In the final section for Giving and Investing, they have $600 to use. They chose to tithe some and use the rest for investing.

70 20 10 Budget Tools

Creating a 70/20/10 budget isn’t too complicated, but having some tools to use will make it even easier, and help you stay organized.

70 20 10 Budget worksheet

As mentioned above, we designed a printable worksheet that is fun and easy to use, to help you create a 70-20-10 budget for your income.

The worksheet walks you through creating a budget using the 70-20-10 budget rule so that you can start budgeting right away.

Using the form is pretty straightforward.

In the Income section, enter the source of your income, how much you will receive and add up the total from all jobs.

Second, move onto the needs section. Calculate what 70% of your income is.

Enter this amount on the line. Then fill in your expenses and the amounts for each in the table. Add them up at the bottom.

Next, fill in the Savings/investing section. Calculate how much will go to your savings goals (20% of income). In the chart you can specify your savings goals and a dollar amount to go towards each.

Finally fill in the Tithing/investing section, as you did the previous two sections, with 10% of your income.

Along the way you will calculate if there is any money “leftover” in each section. If so, you can use that money to save more, payoff debt, cover other needed expenses or do something fun with it.

Also included is a section to write your money goals for the month, to help you stay focused with your budget and dreams.

We love this printable and how easy it is to use for your budgeting plans. It will really help you get started with a budget and deciding where your money should go.

70/20/10 Budget Spreadsheet

And, if paper and pen are not your style, we also have a budget spreadsheet, specifically designed for the 70/20/10 budget.

With this spreadsheet you just put in your paycheck amount, and the math is all done for you!

Then you add in all your expenses, savings goals, debt payments, etc and the spreadsheet will let you know if you are over or under for each percentage.

It even comes with an expense tracking sheet you can see how your real spending compares to your planned expenditures.

You can get that spreadsheet here.

Time to use the 70/20/10 Budget

Okay! You have seen how the 70/20/10 budget method works, and we have show you some tools you can use to help you get started.

We really like how simple this budget process is, and that it can work for so many different budgets and circumstances.

If you think the 70/20/10 budget would work for you, give it a shot! Use our worksheet or spreadsheet to get started and see how it goes.

What do you have to lose?!

If you want to explore some other budgeting methods, check out all of our Budget Worksheets!

Have questions? Leave a comment and let me know. I am happy to answer!